A Decade of Rewards: $75 Bil From Philip Morris International Stock

In the last decade, Philip Morris International (PM) stock has returned a notable $75 Bil back to its shareholders through cold, hard cash via dividends and buybacks. PM S&P Median Dividends $74 Bil $4.5 Bil Share Repurchase $984 Mil $5.6 Bil Total Returned $75 Bil $9.4 Bil Total Returned as % of Current Market Cap 27.3% 24.6%Why should you care? Top 10 Stocks By Total Shareholder ReturnTotal Money Returned As % Of Current Market Cap via Dividends via Share Repurchases AAPL $847 Bil 22.3% $141 Bil $706 Bil MSFT $368 Bil 10.5% $169 Bil $200 Bil GOOGL $357 Bil 8.9% $15 Bil $342 Bil XOM $218 Bil 37.7% $146 Bil $72 Bil WFC $212 Bil 75.5% $58 Bil $153 Bil META $183 Bil 10.8% $9.1 Bil $174 Bil JPM $181 Bil 21.8% $0.0 $181 Bil JNJ $159 Bil 29.8% $105 Bil $54 Bil ORCL $158 Bil 30.2% $35 Bil $123 Bil CVX $157 Bil 48.2% $99 Bil $58 BilFor full ranking, visit Buybacks & Dividends RankingWhat do you notice here? (see Buy or Sell Philip Morris International Stock for more details)Philip Morris International FundamentalsRevenue Growth : 7.5% LTM and 8.0% last 3-year average. Recent Revenue Shocks : The minimum annual revenue growth in the last 3 years for PM was 7.5%.

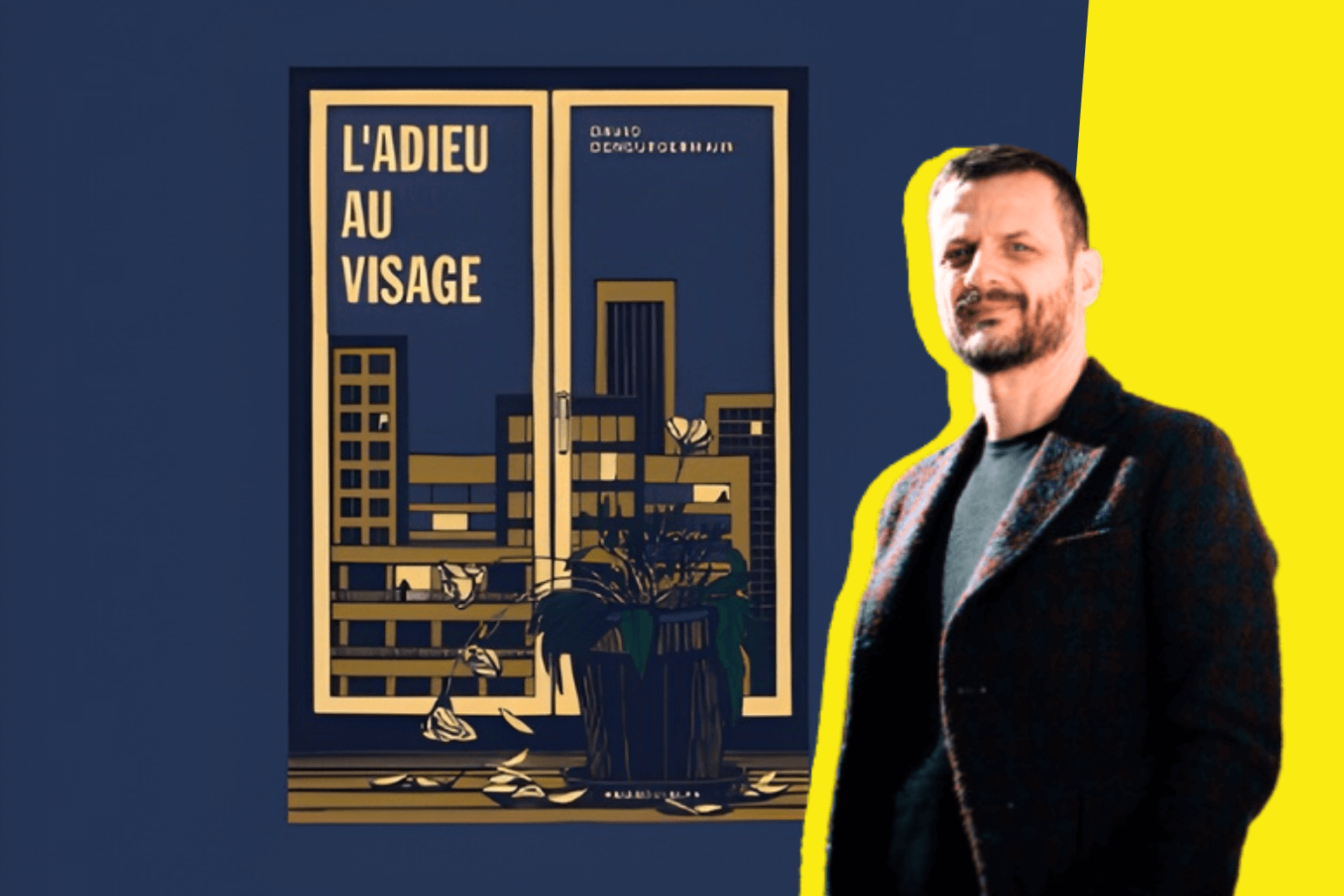

Source: International New York Times January 27, 2026 17:35 UTC