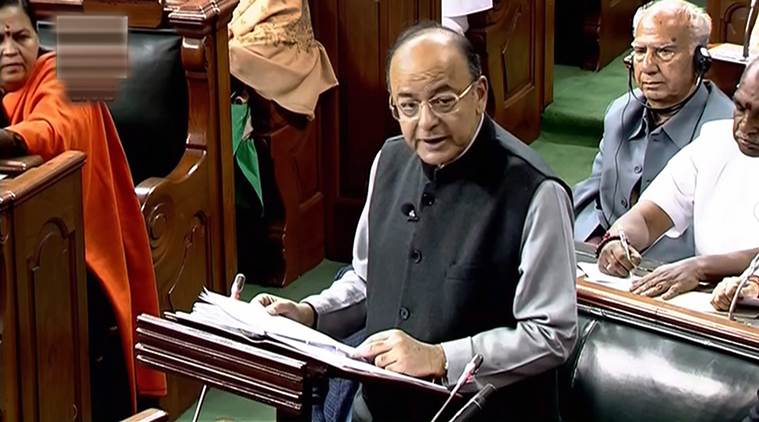

Budget 2018: Arun Jaitley announces relief for MSMEs

In last year’s budget, the government had provided tax sops to MSMEs to make them more viable, recognizing their importance in economic activity and generating employment. It had reduced the income tax to 25% for small companies with annual turnover up to Rs50 crore. This is estimated to have benefited more than 667,000 companies, with 96% of all the companies filing tax returns. In addition, Jaitley also allocated Rs3,794 crore for credit support to MSMEs. Aimed at easing cash flow challenges, these announcements come in the backdrop of demonetisation in November 2016 and the introduction of goods and services tax (GST) in July 2017.

Source: Mint February 01, 2018 07:18 UTC