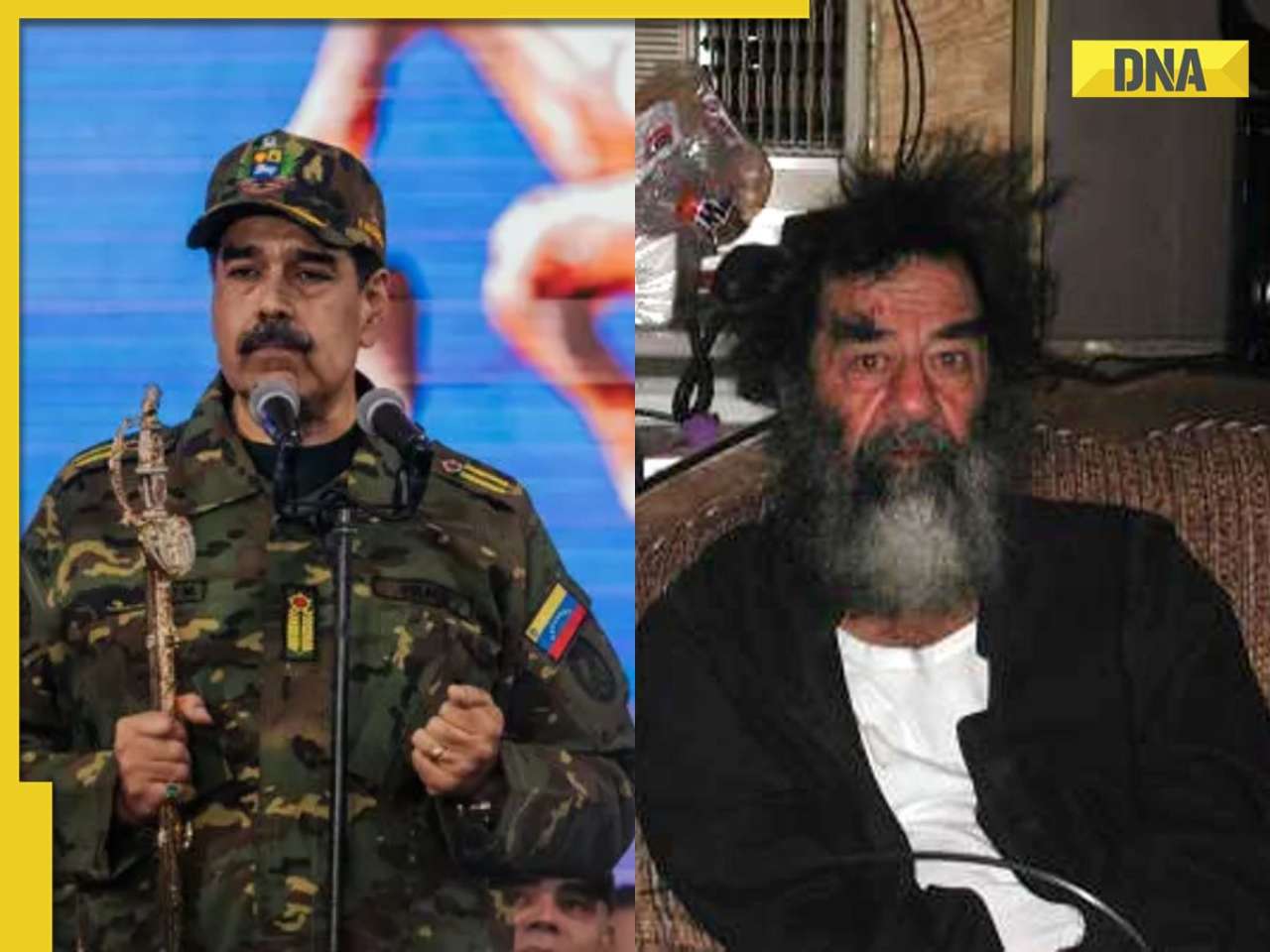

Markets brace for volatility after US capture of Maduro sharpens geopolitical risk outlook

ADVERTISEMENT"The events are a reminder that geopolitical tensions continue to dominate the headlines and drive the markets," said Marchel Alexandrovich, an economist at Saltmarsh Economics. "It is clear that the markets are having to cope with significantly more headline risk than they are accustomed to under the previous U.S. "Markets sometimes swing into risk-off mode on expectations of conflict, but once the conflict starts, they rotate quickly to risk-on." Over the longer run, a more stable, productive and prosperous Venezuela could offer the world significant supplies of oil, he said. "That would be significant for global growth, but it will take political stability and considerable investment to unlock that potential."

Source: The Telegraph January 04, 2026 15:18 UTC