Rajbari, Dhaka reach final in Dholeshshari zone

Photo: BSSDHAKA, Jan 16, 2026 (BSS) - Rajbari and Dhaka U-17 district football teams stormed into the final in Dholeshshari zone of U-17 National Football Championship eliminating their respective rivals in the semifinals held at Rajbari district Stadium in Rajbari today (Friday). The final of the championship will be held on Sunday (Jan 18) at the same venue at 2 pm. In the day's first semifinal, Rajbari beat Madaripur by 2-0 goals with Arafat Sikder scored both the goals for the winners' in the 1st and 20th minutes. in day's second keenly contested semifinal, Dhaka district team beat Narayanganj district team by 5-4 goals in penalty shoot out after the regulation time failed to break the deadlock. In the penalty shootout, the Dhaka district goalkeeper performed brilliantly, blocking multiple Narayanganj shots and playing an important role in the team's victory.

Source:Bangladesh Sangbad Sangstha

January 16, 2026 20:51 UTC

Hopkinton opens community center that brings learning and opportunity together

You have permission to edit this article.

Source:Daily Sun

January 16, 2026 19:57 UTC

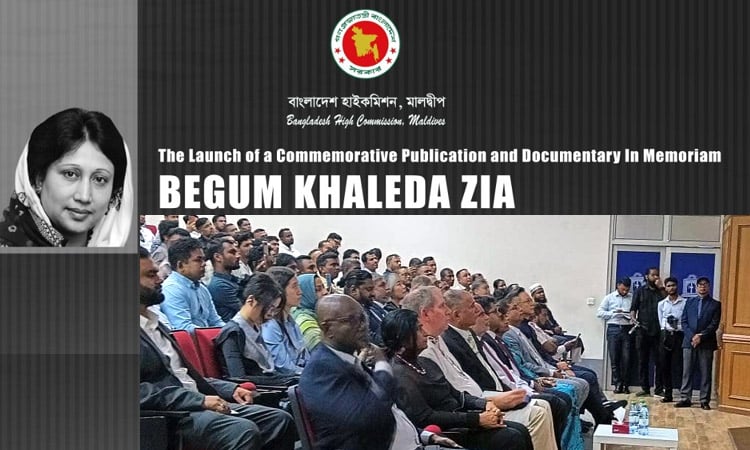

Civil society remembers Khaleda Zia

A civic condolence meeting was held in the capital on Friday to commemorate the late BNP chairperson and former prime minister Begum Khaleda Zia. No representatives of the BNP or members of Khaleda Zia’s family addressed the gathering. Law adviser Dr Asif Nazrul Islam said Khaleda Zia possessed many extraordinary qualities. Prof Dr Mahbub Ullah said Khaleda Zia would be remembered forever for her immense sacrifice and dedication to the country. In his concluding remarks, former chief justice Syed JR Modassir Hosain said: “Khaleda Zia represents a significant chapter in Bangladesh’s political history.

Source:Dhaka Tribune

January 16, 2026 18:11 UTC

Several routes closed for lack of navigability in Jamuna River

Several routes in Sariakandi upazila of Bogra have been closed due to navigability crisis in theJamuna River. Several ferry ghats—including Altaf Ali Ghat at Partit Parol village, Hasnapara, Nijbalai,Dighapara and Charalkandi—have remained closed for months due to the navigability crisis. Altaf Ali, a boatman at the Altaf Ali ferry ghat, said the ghat has remained closed for monthsbecause of low water levels. Aminul Islam, a boatman at Kalitala ferry ghat, said boats are repeatedly getting stuck onsandbars. “Once the port is established, the river route will remainunder year-round dredging,” he said, advising the parties concerned to contact the BangladeshInland Water Transport Authority (BIWTA).

Source:Dhaka Tribune

January 16, 2026 18:00 UTC

Shafiqul: Awami League voters will vote for their preferred candidates

Chief Adviser’s Press Secretary Mohammad Shafiqul Alam said voters affiliated with the Awami League will turn out and vote for candidates of their choice in the upcoming election. “Many ask what Awami League voters will do when they go to polling centers. Awami League voters will come and vote for their preferred candidates,” he said while speaking as the chief guest at an exchange of views with journalists at the Brahmanbaria Press Club on Friday afternoon. He added that no one was advocating on behalf of the Awami League, which he accused of past abuses, including branding protesters as militants. The exchange meeting was chaired by Brahmanbaria Press Club President Javed Rahim Bijan.

Source:Dhaka Tribune

January 16, 2026 18:00 UTC

CA working to ensure credible, widely accepted election: Supradip

Adviser Supradip Chakma today spoke at a view-exchange meeting on the referendum and voter motivation campaign at Khagrachari Town Hall. Photo : BSSKHAGRACHARI, Jan 16, 2026 (BSS) - Chittagong Hill Tracts (CHT) Affairs Adviser Supradip Chakma today said the Chief Adviser is taking strong measures to ensure a transparent, credible, and widely accepted election, with around 90 percent of polling centers to be brought under closed-circuit television (CCTV) surveillance. "To make the election transparent, about 90 percent of polling centers will be monitored through CCTV, and police personnel at each center will also be equipped with body cameras," he said. "As a result, no one will have the opportunity to engage in misconduct or act arbitrarily at polling centers during this election," the adviser said. The adviser called on all concerned to cooperate in ensuring a victory for the 'yes' vote in the referendum.

Source:Bangladesh Sangbad Sangstha

January 16, 2026 17:51 UTC

Government employees observe symbolic hunger strike in Thakurgaon

Government employees observed a symbolic hunger strike in Thakurgaon on Friday to presshome their various demands, including implementation of discrimination-free 9th payscale—based on a 1:4 ratio and 12-grade structure. The demands also include setting a minimum salary of Tk 35,000, and publication of the payscale gazette promptly and its implementation since January 1, 2026. The program was organized by Thakurgaon District Branch of Bangladesh GovernmentEmployees Coordination Council. The hunger strike took place at Thakurgaon Press Clubpremises from 9:30 am to 12:30 pm on Friday. District branch’s Chief Adviser Dabirul Islam, President Nazmul Haque, Delwar Hossain, AminulIslam, and other leaders spoke at the program.

Source:Dhaka Tribune

January 16, 2026 17:42 UTC

Rokeya Award distribution held at DU

Dhaka University Rokeya Hall organized a series of day-long programmes on Thursday to observe Rokeya Day. Photo: BSSDHAKA, Jan 16, 2026 (BSS) - The Dhaka University (DU) Rokeya Hall organized a series of day-long programmes on Thursday to observe Rokeya Day, culminating in the distribution of the prestigious Begum Rokeya Memorial Foundation Gold Medal and Scholarships. The day's festivities included a colorful rally, the 37th Begum Rokeya Memorial Foundation commemorative lecture, and an award ceremony held at the Rokeya Hall auditorium in the evening, said a press release. Congratulating the awardees, he described them as the "successors of Begum Rokeya" and urged them to spread the light of knowledge throughout society. This year, Jayanti Ghosh, a student from the Department of Mathematics, was honored with the 'Begum Rokeya Memorial Foundation Gold Medal'.

Source:Bangladesh Sangbad Sangstha

January 16, 2026 17:41 UTC

Ripon brilliance confirms Rajshahi's top 2 finish

The victory confirmed Rajshahi's top-two finish on the points table alongside Chattogram Royals, ensuring a place in Qualifier 1 on January 21. Sylhet could have stayed in contention for a top-two finish had they won the game. Moeen was eventually dismissed for a brisk 27 off 12 balls, an innings laced with one four and three sixes. Rajshahi's innings was anchored by senior batters Mushfiqur Rahim and Najmul Hossain Shanto, who added 56 runs for the third wicket after the team slumped to 27-2 inside four overs. The departure of the duo stalled Rajshahi's momentum, and they fell short of the 150-run mark.

Source:Bangladesh Sangbad Sangstha

January 16, 2026 17:37 UTC

Plastic waste cleanup drive held in Chalan Beel

A plastic waste cleanup drive was arranged in Chalan Beel today. Photo: BSSNATORE, Jan 16, 2026 (BSS)- A plastic waste cleanup drive was arranged in Chalan Beel today to make the wetland free from pollution with spontaneous participation of locals. The drive was undertaken aimed at enhancing its agricultural utility and protecting environment of the vast wetland, organizers said. Chalan Beel Biodiversity Protection Committee initiated the cleanup drive at Tishikali Shrine area. Longtime dumping of plastic wastes, glasses and food packets made the aquatic resources of the wetland endangered as well as decreasing the fertility of agricultural land.

Source:Bangladesh Sangbad Sangstha

January 16, 2026 17:16 UTC

Yes, the Front Range is extremely dry and warm this winter. Here’s what you should do.

So you think that 5 inches of snow in central Denver a week ago lets the Front Range off the hook for a worrisome urban and suburban winter drought? December’s average temperatures in Fort Collins were just a tenth of a degree lower than the 30-year average for March. Total 2025 precipitation in central Denver at the gardens was 12.06 inches, the second-driest year since 2007, following only notorious 2020. The Boulder forester suggests another standard of 15 gallons of water per inch of trunk diameter. If things remain dry on the Front Range, watering once or twice a month will help preserve your plants.

Source:Daily Sun

January 16, 2026 17:10 UTC

Fire service: Uttara residential building fire due to electrical fault

A fire that killed six people at a residential building in Uttara was caused by an electrical fault, the Fire Service and Civil Defence Directorate said on Friday, based on preliminary findings. The blaze originated from an electrical fault in a section of the second floor of the seven-story building, Fire Service media cell official Talha bin Jasim told Dhaka Tribune. According to the Fire Service, property worth Tk45,00,000 was damaged in the fire, while assets worth Tk2,00,00,000 were rescued. Two units from the Uttara Fire Station rushed to the scene and brought the fire under control after about 30 minutes. Residents of the seven-story building panicked as dense smoke spread throughout the structure, trapping several people.

Source:Dhaka Tribune

January 16, 2026 17:00 UTC

Asif Nazrul: Khaleda was convicted in Bangladesh’s most disgraceful trial

Law Adviser Asif Nazrul on Friday said former prime minister Khaleda Zia was unjustly convicted in what he described as the most disgraceful and farcical trial in Bangladesh’s history, referring to the Zia Orphanage Trust corruption case. He recalled an incident from the trial, saying a defence lawyer had asked Khaleda Zia whether she had misappropriated orphan funds. “Hurt and astonished, Khaleda Zia repeated the question—‘Did I embezzle orphan money?’ The court treated this as her statement and convicted her on that basis. As a student of law, I can say with certainty that there cannot be a more disgraceful trial than this,” the law adviser said. Asif Nazrul remarked that Bangladesh would prosper only if the country is envisioned in the way Khaleda Zia had envisioned it.

Source:Dhaka Tribune

January 16, 2026 17:00 UTC

Salehuddin: RNPP to play groundbreaking role in power sector

Science and Technology Adviser Salehuddin Ahmed on Friday expressed his hope that the Rooppur Nuclear Power Plant (RNPP) will play a groundbreaking role in the national power sector. The adviser visited the plant construction site project in Ishwardi, Pabna on Friday and observed progress of the work. The nuclear power plant is being established following all international rules and regulations. During the inspection, Cabinet Secretary Dr Sheikh Abdur Rashid, Finance Secretary Dr Md Khairuzzaman Mazumder, Economic Relations Division Secretary Md Shahriar Quader Siddiqui, Science and Technology Secretary Md Anwar Hossain were present. Chairman of Bangladesh Atomic Energy Commission, Bangladesh Atomic Energy Authority and the Rooppur Nuclear Power Plant Construction Project Director were present at the time.

Source:Dhaka Tribune

January 16, 2026 17:00 UTC

EC approves 18 appeals on seventh day of hearings

The Election Commission (EC) on Friday approved 18 appeals on the seventh day of hearings challenging Returning Officers’ decisions on nomination papers for the 13th National Parliament elections. EC sources said the commission heard a total of 43 appeals. Of these, 18 appeals against the cancellation of nomination papers were accepted, while 17 were rejected. The EC also turned down four appeals filed against the acceptance of nomination papers and kept four appeals pending. The EC said appeals numbered 511 to 610 will be heard on Saturday at the auditorium of the Election Building in Agargaon, Dhaka, from 10am to 5pm.

Source:Dhaka Tribune

January 16, 2026 17:00 UTC