What APL said about external flows and BoG currency data

The Bank of Ghana's own footnote attests to the fact that some of the gold stock was monetized into cash FX and reflected in Gross International Reserves. This explains why gold value fell from USD 3.43 billion to USD 2.68 billion, while GIR rose from USD 11.60 billion to USD 13.83 billion and Net International Reserves increased from USD 9.40 billion to USD 11.71 billion over the same period. Prof Isaac Boadi claims that exchange-rate data and significant external flows reveal a basic inconsistency in the Governor's actions. Such circumstances should naturally replenish reserves and lessen the need to liquidate strategic assets, according to standard central bank reasoning. This implies that even with the headline current-account surplus, the Bank's immediate liquidity needs could not be met by the surplus alone.

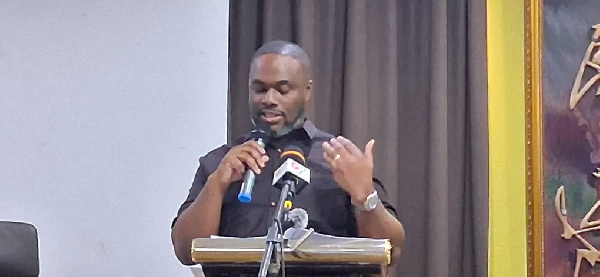

Source: GhanaWeb January 29, 2026 11:03 UTC